Knowledge Sharing

Communities are excellent platforms for the exchange of knowledge and information. Members can share insights, expertise, and resources, fostering a collective learning environment.

Join Our Community

Trading Unlocking Diversified

Covesting allows you to automatically copy top performing traders and achieve the returns

Communities often provide emotional support and encouragement. Whether it's a professional community, a hobbyist group, or a social network, being part of a community can help you navigate challenges, share experiences, and receive motivation from like-minded individuals.

Join Our Community

Communities are excellent platforms for the exchange of knowledge and information. Members can share insights, expertise, and resources, fostering a collective learning environment.

Join Our CommunityCommunities offer networking opportunities, enabling you to connect with people who share common interests, goals, or professional pursuits. Networking within a community can lead to collaborations, partnerships, and career opportunities.

Communities foster collaboration and teamwork. Whether in a professional or recreational setting, working together toward common goals can lead to more effective problem-solving and project outcomes.

Within a community, individuals have the chance to showcase their skills and achievements. Recognition from peers can boost confidence and open doors to additional opportunities.

A forex broker is a financial intermediary that enables retail traders to access the foreign exchange market and execute trades. These brokers act as a bridge between individual traders and the larger interbank forex market.

It's crucial to choose a forex broker that is regulated by a reputable financial authority. Regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK, the Commodity Futures Trading Commission (CFTC) in the United States, or the Australian Securities and Investments Commission (ASIC) in Australia, impose certain standards and regulations to protect traders. Regulation helps ensure transparency and the safety of clients' funds.

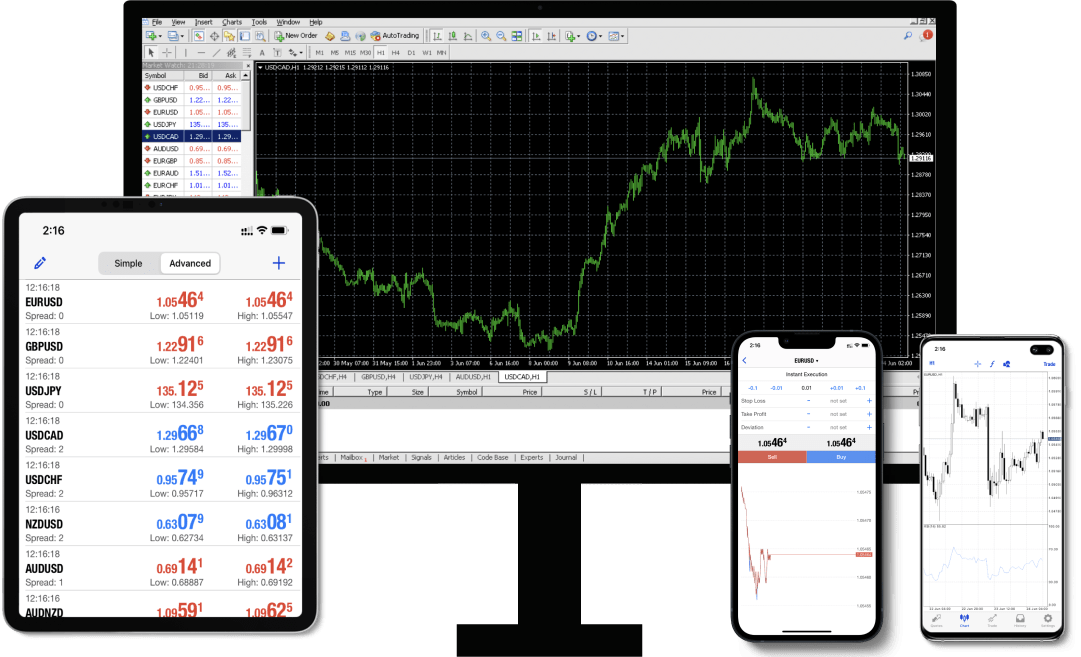

Brokers offer trading platforms for clients to execute trades and manage their accounts. The platform should be user-friendly, stable, and provide the necessary tools and features for analysis. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are popular trading platforms in the forex market.

Forex brokers make money through spreads (the difference between the bid and ask prices) and, in some cases, through commissions. It's essential to consider the cost of trading, including spreads and any additional fees or commissions.

The foreign exchange market has emerged as the largest financial market in the world owing to its accessibility, liquidity and trading pairs. You can buy and sell currency over the counter to turn a profit.

The foreign exchange market is truly expansive with traders participating from all parts of the world. The importance of foreign exchange market is evident from the fact that more than $4 trillion are exchanged on an average in the currency market every day. Other factors that make it a lucrative trading place are largely derived from the fact of the market's sheer size.

Given that the forex market is global, trading can take place almost continuously as long as a market is open somewhere in the world. It operates five days a week, for 24 hours each day. The first major market opens in Australia’s Sydney at 5 pm on Sunday and trading ends when the US’ New York market closes at 5 pm on Friday.

There is a large number of participants in the forex market, which is why no single player, but only external factors such as the economy can control prices. This factor reflects the importance of foreign exchange as an investment option on traders’ portfolios. No middlemen exist in this market, and brokers only help connect buyers and sellers.